More Articles

- What Irs Form Is Used For Gambling Losses

- What Form Do You Use For Gambling Losses

- What Form To Use For Gambling Losses

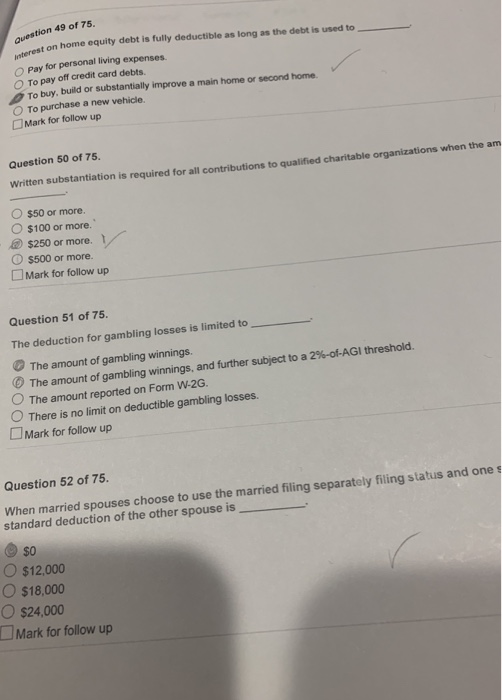

Gambling losses can only be deducted up to the amount of the gambling winnings. Gambling winnings are reported on Form 1040 Line 21 as Miscellaneous Income. Gambling Losses are reported on Form 1040 Schedule A as a Miscellaneous itemized deduction. Gambling losses are not a one-for-one reduction in winnings. Professional gamblers are required to file a Schedule C (Form 1040), and can often find themselves in hot water with the IRS for not complying or correctly reporting their losses. It is in the best interest of anyone who falls under this category to pair themselves with a tax professional that can help guide them through the process.

If you had a successful night at the slots or poker tables, you're going to have to share some of the lucky proceeds with Uncle Sam. The Internal Revenue Service generally requires that you report your gambling winnings and losses separately when you file your taxes rather than combining the two amounts.

Record Keeping

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

- tax forms image by Chad McDermott from Fotolia.com

Read More:

Author

Do you roll the dice? Enjoy the slot machines? Even as a casual gambler, your winnings are fully taxable and must be reported on your tax return. Learn more about how the Tax Cuts and Jobs Act impacts gambling.

There are unique considerations when it comes to disclosing gambling wins and losses on your tax return….modified recently under the Tax Cuts and Jobs Act (TCJA). If you gamble, make sure you understand the tax consequences.

First off—what counts as gambling in the eyes of the IRS?

Gambling income includes (but is not limited to)

- Winnings from

- Lotteries

- Raffles

- Horse races

- Casinos

- Cash winnings

- Fair market value of prizes (like cars and trips)

The general rules

Wins

What Irs Form Is Used For Gambling Losses

You are required to report 100% of gambling winnings as taxable income on your 1040. In addition, all complimentary offerings provided by casinos and gambling establishments must also be included in winnings. Winnings are subject to your federal income tax rate (though rates have been reduced under the TCJA-check out our blog, 2018 Tax Reform Provisions for Individuals for more on this).

Also, if you receive a certain amount of gambling winnings or if you have any winnings that are subject to federal tax withholding, the payer must issue you a Form W-2G “Certain Gambling Winnings”.

In other words, the payer is required to issue you a W-2 G if you receive (according to the IRS).

- $1,200 or more in gambling winnings from bingo or slot machines;

- $1,500 or more in proceeds (the amount of winnings minus the amount of the wager) from keno (a game of chance similar to lotto);

- More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament;

- $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least 300 times the amount of the wager; or

- Any other gambling winnings subject to federal income tax withholding.

Losses

Gambling losses can be written off as miscellaneous itemized deductions. The gambling loss deduction is limited to the extent of your winnings for the year and excess losses cannot be carried forward to future years.

/cookie-shop-revenue-58d93eb65f9b584683981556.jpg)

Under the TCJA, misc. deductions subject to the 2% of adjusted gross income floor are not allowed, however certain deductions (including the gambling loss deduction) are still deductible.

However, since the standard deduction for 2018 was nearly doubled by the TCJA, many taxpayers may no longer benefit from itemizing, seeing as itemizing saves tax only when the total itemized deductions exceed the applicable standard deduction.

What Form Do You Use For Gambling Losses

How do you claim a deduction for gambling losses?

What Form To Use For Gambling Losses

Recordkeeping is key!

To deduct gambling losses, you must document:

- The date and type of gambling activity

- The name and address of the gambling establishment

- The names of anyone who was present with you at the gambling establishment

- The amount won or lost

**You can document gambling on table games by recording the number of the table you played and retain statements showing casino credit issued to you. As far as lotteries go, you can use winning statements and unredeemed tickets as documentation.

Key takeaway

The TCJA adds limitations to the gambling loss deduction — you can now only deduct losses up to the amount of your winnings. Any excess loss cannot offset other highly taxed income. Thus, those in the trade or business of gambling, may no longer deduct non-wagering expenses, such as travel expenses or fees, to the extent those expenses exceed gambling gains.

Questions? Contact us.

The TCJA…So Many Changes, So Many Questions…we can help you navigate this huge tax overhaul! Visit our Tax Reform Center for everything you and your business need to know, now.

Newsletter

Get KLR updates delivered to your inbox.

Subscribe